A retenir

- L’AG est un moment-clé de la vie d’une entreprise, obligatoire dans certaines formes sociales, pour valider les comptes, modifier les statuts ou nommer les dirigeants.

- Un formalisme strict s’impose : convocation, ordre du jour, quorum, procès-verbal… Toute irrégularité peut entraîner la nullité des décisions.

- Une documentation rigoureuse est requise : feuille de présence, PV, registre des AG, indispensables en cas de litige ou de contrôle.

- Les règles varient selon la structure (SARL, SA, association, copropriété) : il faut adapter l’AG à la forme juridique.

- Le rôle d’un avocat est essentiel : préparation, vote, conformité, contentieux éventuel. Il est un acteur clé des AG sensibles.

In the life of a company, theAnnual General Meeting is never simply a legal obligation: it is the collective decision-making body par excellence. Partners, shareholders, agents and managers are called to the table to debate, vote and map out the company’s future. This annual ordinary or extraordinary meeting sets crucial decisions: approval of the accounts, allocation of profits, appointment of directors, adoption of new resolutions.

But be careful: nothing is left to chance. Convening the meeting by registered letter, respecting deadlines, checking quorum, ensuring that minutes are accurate, filing with the registry… everything must comply with the French Commercial Code and the company’s Articles of Association. If a document is omitted or an error is made, the penalty can be severe: the decision may be null and void, or the directors may be held liable. Properly conducted, however, the AGM becomes a strategic lever, an opportunity to enhance transparency, involve each member and make corporate management a genuine tool for performance and confidence.

With Goldwin Avocats in Paris, experts in company law, you can find out all about the obligations, formalities and best practices for managing your general meetings and making them a real strategic asset.

Key points to remember:

- The AGM is a key moment in the life of a company, and is compulsory for certain types of company to approve accounts, amend the Articles of Association or appoint directors.

- Strict formalities are required: notice of meeting, agenda, quorum, minutes, etc. Any irregularities may invalidate the decisions taken.

- Rigorous documentation is required: attendance sheet, minutes, AGM register, which are essential in the event of a dispute or audit.

- The rules vary depending on the structure (SARL, SA, association, co-ownership): the AGM must be adapted to the legal form.

- The role of a lawyer is essential: preparation, voting, compliance and any disputes that may arise. He is a key player in sensitive AGMs.

What is a general meeting?

Definition and role of a GM

TheAnnual General Meeting is a formal meeting at which members or shareholders come together to debate and approve strategic choices. It is the body where the floor is open, votes are counted and resolutions are passed or rejected. Each AGM is convened to answer specific questions on a pre-set agenda.

The essential functions of the AGM

A General Meeting is more than just a discussion between directors. It must fulfil several functions:

- approve the annual financial statements

- decide on theallocation of profits,

- electing or dismissing directors

- authorise certain management actions,

- amend the Articles of Association.

These functions are governed by the law and the company’s Articles of Association, which means that strict formalities must be observed.

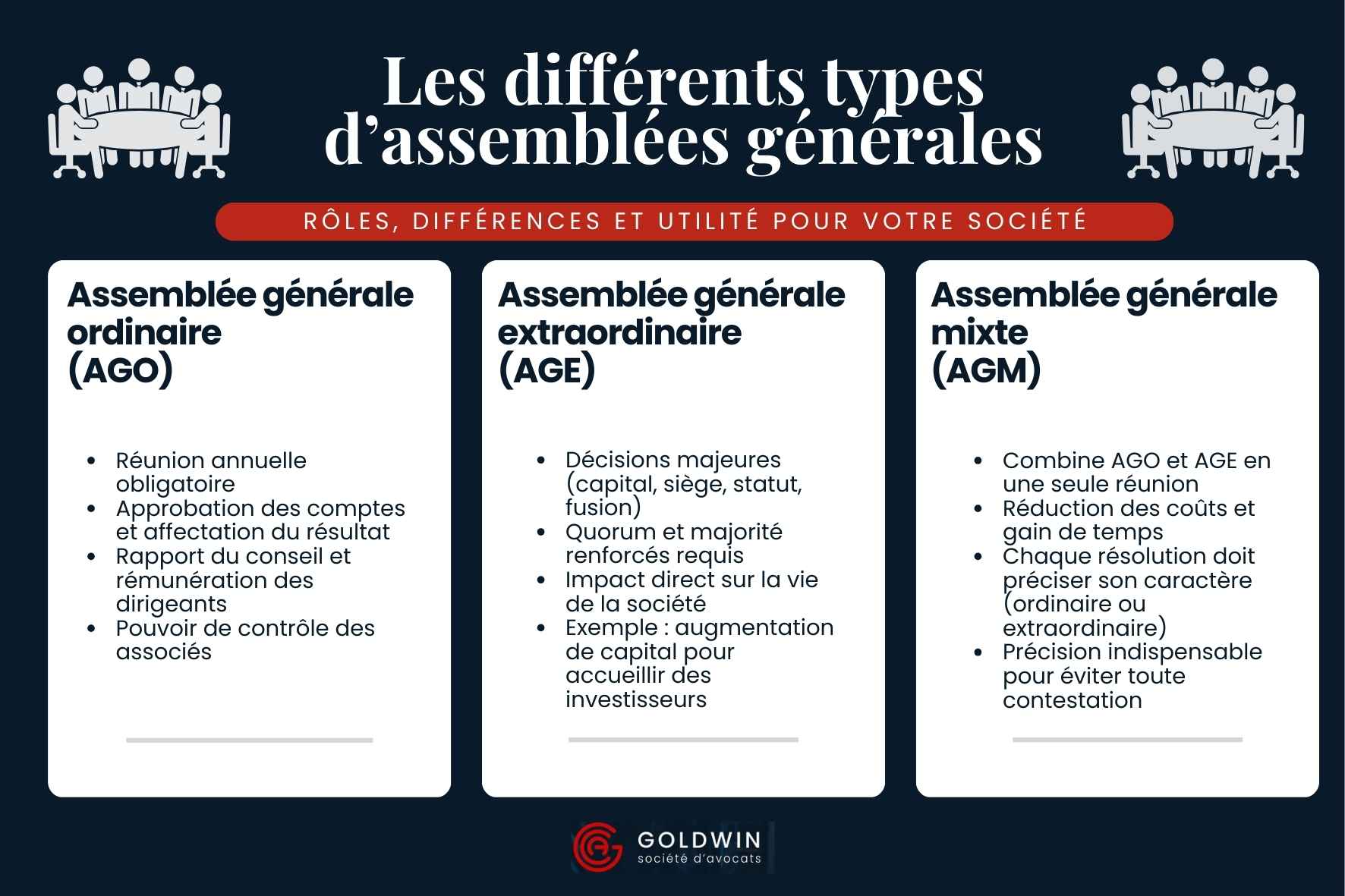

The different types of general meeting in a company

Ordinary General Meeting (OGM)

The AGM is the most common type of meeting. Held at least once a year, it is used to approve the accounts for the financial year, allocate profits, examine the Board of Directors’ report and decide on the remuneration of directors. The meeting must be held within a specific timeframe, generally within six months of the end of thefinancial year. This is an opportunity for each shareholder to exercise their power of control and to intervene in the day-to-day management of the company.

Extraordinary General Meeting (EGM)

An Extraordinary General Meeting is called when major decisions need to be taken, such as increasing the company’s capital, changing its registered office, changing its legal form, adopting an agreement or approving a merger. It requires a stronger quorum and majority, because its collective choices have a profound effect on the life of the company.

For example, when an SARL wants to increase its capital to welcome new investors, it must convene an EGM and comply with the strict requirements for convening and voting.

Combined General Meeting (AGM)

The Combined General Meeting combines OGMs and EGMs in a single meeting. It is common in public limited companies (SA) and large simplified joint stock companies (SAS), as it saves time and costs. However, each resolution must clearly state whether it is an ordinary or extraordinary resolution. This distinction is essential to avoid any subsequent disputes.

In addition to the 3 main types of meeting, there are a number of other specific types of meeting that can be held during the life of a company:

- Constituent meeting: the first meeting of the founders, it approves the company’s articles of association, appoints the directors, fixes the registered office and, if necessary, appoints the auditor.

- Annual General Meeting: compulsory for all companies. It approves the accounts, decides on the allocation of profits and validates the management report.

- Special Meeting: convened for a category of shareholders (e.g. preference shares) to protect their special rights.

- Merger or demerger meeting: adopts a resolution to restructure the share capital, often following a report from the auditor.

- Consultative meeting: brings together shareholders to give a non-binding opinion, useful for management and transparency.

Calling a company general meeting

Who can convene the AGM?

Calling the meeting depends on the type of company.

- In a SARL, the managing director convenes the meeting.

- In a SAS, the Chairman or a body provided for in the Articles of Association.

- In a SA, the Board of Directors or the Management Board.

If no meeting is called, an auditor or even a judge may authorise the meeting to be called. This option prevents a director from deliberately blocking a General Meeting.

In addition, even if the meeting is convened in person, a person who is unable to attend may give a proxy todo so.

Who should be invited to a general meeting?

The General Meeting is not just attended by the shareholders. It must also include non-member directors, the statutory auditors where they exist, and representatives of the social and economic committee (CSE) in the structures concerned. Failure to include an auditor can result in up to two years’ imprisonment and a €30,000 fine.

In joint-stock companies, a notary may be required to authenticate certain deeds, such as a capital increase. Finally, third parties such as lawyers, auditors or journalists may be invited to provide expertise, transparency and legal certainty to the deliberations.

Deadlines and procedures for convening meetings

The notice period is the time between the dispatch of the notice and the date set for theGeneral Meeting.

This period has a clear objective: to allow shareholders to examine the relevant documents before the meeting and to exercise their right of control to the full.

- In the case of a SARL (limited liability company), notice of the meeting must be sent to the shareholders at least 15 days before the scheduled date.

- In a SA: the deadline is longer, often set at 30 days.

- In an SAS: the law leaves the shareholders a great deal of freedom. The deadline is set out in the company’s articles of association, whether for an OGM or an EGM.

Please note: regardless of the form chosen, failure to comply with these laws may result in the nullity of the resolutions passed and in the executive being held liable.

Mandatory content of the notice of meeting

The notice of meeting marks the official start of the process. It is drafted and sent by the manager, the chairman or the competent body, depending on the legal form. In the absence of such a body, the statutory auditor, or even a court-appointed agent, may take charge.

It must include the following information:

- the date

- the time

- the place of the meeting

- the list of items to be discussed

- the draft resolutions to be put to the vote,

- the financial statements for the accounts approval meeting,

- the documents required for the debates.

The arrangements vary depending on the structure: in a SARL, the notice is sent by registered letter(15 days for an AGM, 21 days for an EGM); in a SAS, it is freely organised via the articles of association (simple letter, registered letter, e-mail); and in a SA, it is sent 30 days in advance.

IMPORTANT : Failure to comply with the required formalities mayresult in theGeneral Meeting being declared null and void, along with any resolutions passed.

The procedure and practical organisation of a general meeting

Organising a general meeting is not something you can improvise. Here is an infographic on how a general meeting is organised and the role of a lawyer at each stage:

Preliminary stages

Before any meeting, a number of documents must be drawn up: balance sheet, profit and loss account, management report and proposed appropriation of profits. These documents must be sent to the participants within the legal or statutory deadlines, so that they can analyse the data and prepare their speeches. The aim is to guarantee informed consultation and transparent decision-making.

Approval of the company’s annual accounts

Formal approval of the accounts is a key point at theAnnual General Meeting. The members examine the financial statements, decide whether or not they are accurate, and then decide how toallocate the profits: to reserves, dividends or retained earnings. A practical example: an SME may choose to keep its surplus to finance an extension rather than distribute it. This decision, which affects the future of the company, must be recorded in the minutes.

Stages of the meeting

On the day of the meeting, the attendance sheet is signed by each person present or represented. The Chairman opens the meeting and checks that the minimum quorum has been reached.

The items on the agenda are then dealt with, followed by discussions and voting.

Finally, the meeting is closed after announcing the results and the action to be taken. Any irregularity (e.g. absence of signatures, incorrect vote count) may result in the cancellation of the proceedings.

Agenda

The agenda sets the framework for the meeting. It must be precise, complete and communicated with the notice of meeting. Only the items listed may be dealt with, unless there is unanimous agreement to extend the scope.

For example, at an Extraordinary General Meeting, an amendment to the Articles of Association can only be voted on if it is expressly included in the agenda. This tool provides a framework for debates and secures the process.

Quorum and majority rules

The way things work differs depending on the type of company. In a SARL, certain resolutions require an absolute majority, while others require a reinforced majority. In a public limited company (SA), a minimum percentage of shares must be present or represented in order to deliberate. If the quorum is not reached, a new meeting may be called under simplified conditions.

In a simplified joint stock company (SAS), the internal rules are largely free to set these thresholds.

These mechanisms ensure that the decisive choices are made on a sufficiently representative basis.

Voting and proxies

Votes may be cast by show of hands, by secret ballot or via a secure electronic system. Absentees may delegate their vote to a proxy under the conditions laid down by law or the Articles of Association.

After the meeting

Once the meeting is adjourned, a number of obligations remain:

- drafting and signing the minutes

- filing the financial statements with the Registrar within one month (or two months by electronic means)

- then archiving them in the register.

Important changes, such as the appointment of directors, must be published in a legal gazette to ensure that the information is regulated.

In the event of omission, the authorities may impose a fine of €1,500, increased to €3,000 in the event of a repeat offence.

The Paris law firm GOLDWIN AVOCATS assists companies of all kinds at every stage of their general meetings: preparation, organisation, voting and post-meeting formalities.

Documents relating to the general meeting

Every meeting leaves behind essential written records. These documents structure the proceedings, ensure transparency and provide evidence in the event of a dispute. They should always be drawn up clearly and in accordance with the applicable legal framework.

Attendance sheet

This document lists the people attending the meeting. It includes the surname and first name of each person, their position and the total number of shares held.

Signatures are mandatory: without them, the validity of the meeting may be weakened. This sheet provides proof that the group was meeting on a regular basis and ensures traceability in the event of a subsequent request.

Minutes of the general meeting

The minutes are the official record of the meeting. They describe how the discussions took place, the proposals examined and the final outcome. They must include a number of key points:

- the place of the meeting ;

- the full names of those who took part

- the proposals submitted and the amount of shares represented;

- a summary of the discussions, together with the results obtained;

- any reference documents examined;

- the signatures of the authorised officers.

Depending on the statutory framework, the minutes may also include a prior written consultation or mention of a technical incident during a dematerialised meeting. Once drawn up, the minutes must be signed, archived and, in some cases, registered with the relevant authorities.

Company register of general meetings

Anofficial, numbered document, the register contains all the minutes in chronological order. It is an essential reference document. Its purpose is to ensure that the information recorded is preserved and authentic. In the event of a major change, such as an increase in capital, the register will serve as proof. In the event of a dispute, it can be produced before the competent courts.

Special cases depending on the type of company

General meetings are not governed by the same rules for commercial companies, associations or co-ownerships. Obligations vary according to the legal form, the level of formality required and the importance of the deliberations.

General Meetings of SARLs

In a SARL, an ordinary general meeting (AGM) must be held each year to approve the accounts. Extraordinary general meetings (EGMs) are called for any changes to the articles of association (capital increase, change of corporate purpose, etc.). The meeting is convened by registered letter, and the managing partner must present a full report to the shareholders to inform their decisions.

General Meetings of SAs

In public limited companies, the Board of Directors plays a central role. Shareholders meet to approve the financial statements, decide on management remuneration and approve regulated agreements. Their rights are strengthened:

- the right to detailed information in advance

- the right to ask written questions

- the right to receive dividends

- the right to vote on resolutions.

These prerogatives ensure a balance between the power of management and that of shareholders, who are the guarantors of the company’s capital.

General Meetings in associations

In an association, the framework is defined by the Articles of Association. The General Meeting approves the annual and financial reports, sets the membership fees andelects the officers. Even though the rules are often more flexible than in commercial companies, they must always be followed to the letter to ensure transparency and good internal governance.

General meetings of co-owners

In co-ownership, the rules are governed by property law and vary according to the nature of the deliberations. A simple repair may be adopted by a simple majority, while a change to the common areas requires a reinforced majority, or even unanimity for the most important resolutions. These formalities are designed to protect the collective interests of co-owners and prevent a minority from imposing its choices.

The role of a company lawyer at AGMs

Legal support

Organising a general meeting requires absolute rigour: the meeting must be convened within the legal deadlines, the agenda must be complete, and the quorum and majority requirements must be met. A simple oversight (e.g. failure to convene the auditor) can invalidate any resolutions adopted.

A company lawyer will ensure that every stage of the process is secure, anticipate risks and guarantee that decisions are compliant, so that they cannot be overturned at a later date.

Disputes and litigation

Poorly prepared resolutions are frequently contested by minority shareholders. A capital increase decided on without a reinforced majority, or an approval of accounts voted on without prior communication of documents, may be annulled by the Commercial Court.

In these situations, the lawyer defends the validity of the decisions or acts to obtain their annulment, thereby protecting the interests of his clients.

The intervention of a lawyer is an essential lever: it protects the directors, secures the strategic choices and prevents disputes that can block the life of the company for a long time.

Goldwin Avocats in Paris, experts in business law in Paris, assists companies at every stage of their general meetings: convening, organisation, minutes and defence in the event of a dispute.

Protect your AGMs before it’s too late

A poorly organised general meeting can turn your whole company upside down: resolutions can be quashed, directors can be called to account, financial penalties can be imposed, and disputes can be brought before the courts. Every detail counts: notice of meeting, quorum, approval of accounts, signing of minutes, declaration to the registry. The slightest error is costly and can undermine your strategic decisions.

The time to act is now: entrust your AGMs to Goldwin Avocats in Paris without delay to avoid nullity, protect your interests and turn this regulated moment into a genuine strategic lever.

Frequently asked questions about general meetings

Is it compulsory to hold a general meeting?

Holding a general meeting is compulsory for certain types of company (SA, SARL, SCA, co-ownerships) and is generally provided for in the articles of association of associations. However, other structures(SAS, SNC, non-trading companies) are not legally obliged to do so, unless their articles of association require them to do so.

What are the risks of mismanaging a general meeting?

Failure to comply with the rules governing the convening of meetings, quorum and majority requirements may result in the decisions of the meeting being null and void(article L.235-1 of the French Commercial Code).

For example, if the manager of a limited liability company fails to send out a notice of meeting 15 days before the AGM(article L.223-27), approval of the accounts may be null and void.

In such cases, the directors incur civil liability(article L.223-22) and, in the event of fraud or wilful omission, criminal liability (€9,000 fine for failure to convene – article L.241-5, 4).

How do I challenge a decision taken at a General Meeting?

A decision taken at a shareholders’ meeting can be challenged before the Commercial Court. A partner or shareholder may apply to the court within a period of time, generally three years, to have a resolution quashed. The resolution may be quashed if it contravenes the Articles of Association or the Commercial Code (for example, if the meeting was convened improperly or if there was no quorum).

Goldwin Avocats assists both directors and shareholders in these proceedings, whether to defend the validity of a meeting or to obtain the annulment of an irregular decision.

What is the role of the statutory auditor at a general meeting?

The statutory auditor certifies the fairness of the financial statements and presents his report. He can also call a meeting in an emergency. His role is to guarantee transparency for shareholders and third parties.

Can a General Meeting be organised remotely?

Yes, if the Articles of Association so provide. Many companies now use videoconferencing or electronic voting. This allows for greater participation, but the technical and legal arrangements must be specified in the by-laws.

Who can be a representative at a general meeting?

A shareholder may be represented by a proxy. The proxy may be another member of the company or, depending on the Articles of Association, a third party. Proxies must be drawn up in writing and comply with the limits laid down.