When it comes to fund-raising, the support of a legal expert is essential to secure every phase of the operation. As a strategic ally, a fund-raising lawyer can help you structure yourbusiness project from a legal point of view, define the best financing and investment strategies, and anticipate any risks.

From negotiating with investors to drafting the documentation, this professional provides you with invaluable advice on how to successfully raise capital, optimise the distribution of shares and make the right choices.

This meticulous work also enables you to reassure your future clients and partners about the legal soundness of your project.

The team at Goldwin Avocats, with its recognised expertise in fundraising, will advise you at every stage to ensure that your operation is secure and optimised. This article will help you choose the right lawyer, understand his or her remit, the stages involved in raising funds and the mistakes to avoid.

What is fundraising and why is it strategic?

Definition of fundraising

Raising funds involves bringing external partners into your company’s financial structure. In exchange, you give them a share in the ownership of your company.

For a start-up, for example, this is an effective alternative to traditional financing, such as bank loans, to support the rapid development of the business.

This operation is generally accompanied by the signing of several contracts setting out the rights of these third parties and the company’s commitments. This capital acquisition process is often complex and requires excellent legal and financial expertise to take full advantage.

However, correctly structuring a fund-raising is far from simple. The legal and financial complexity of the process requires the support of a lawyer who is an expert in fund-raising to secure each phase and protect your interests. We explain why.

What are the key stages in successful fundraising?

Preparing your fund-raising file

Preparing your application is fundamental to convincing fund providers. It’s not enough to present an ambitious project: you also need to demonstrate its viability with concrete, quantified evidence.

A detailed business plan, realistic financial forecasts and relevant performance indicators are essential. Your lawyer, in conjunction with thestrategic fund-raisingsupport firm, will ensure that your contractual documents are legally sound.

Careful preparation of your application is essential if you want to raise funds and attract reliable partners.

We help you to anticipate any weaknesses in your application and to prepare precise answers to investors’ questions. Good preparation upstream gives you greater credibility and effectiveness.

Promoting your business effectively

Determining the right value for your legal structure is a delicate exercise. It has to be attractive enough to attract shareholders without selling off your shares.

Our fund-raising consultancy can help you establish a balanced valuation, based on objective criteria such as profitability, growth potential and the strength of your target market. Highlight your company’s strategic strengths, such as innovation or the quality of the management team. This strengthens the legitimacy of your project and justifies your valuation in the eyes of financial partners.

Finding and convincing investors

Finding investors takes time, method and a powerful presentation. You need to target the right investor profiles, in line with your company’s vision, and prepare convincing arguments.

With the help of your lawyer and a fund-raising consultancy, you can structure a clear pitch, backed up by solid financial data and reassuring legal arguments.

Goldwin Avocats can provide you with the benefit of its experience in strategic consultancy to help you structure your presentation effectively and approach the negotiation calmly. Our expertise will help you anticipate objections and effectively defend your company’s interests in discussions with investors.

Finalise the deal with complete legal certainty

Signing the final agreements marks the end of the fund-raising process, but it should not be neglected. It is at this stage that the negotiated clauses take on their full force.

Your lawyer supervises the drafting and signing of the contractual documents to ensure that they are compliant and enforceable. He will also ensure that the closing goes smoothly, i.e. that the agreed conditions precedent are met, and that the funds are actually released. Thanks to this support, you can ensure that the deal is legally secure and that the financing is implemented quickly, which is essential for your company’s growth.

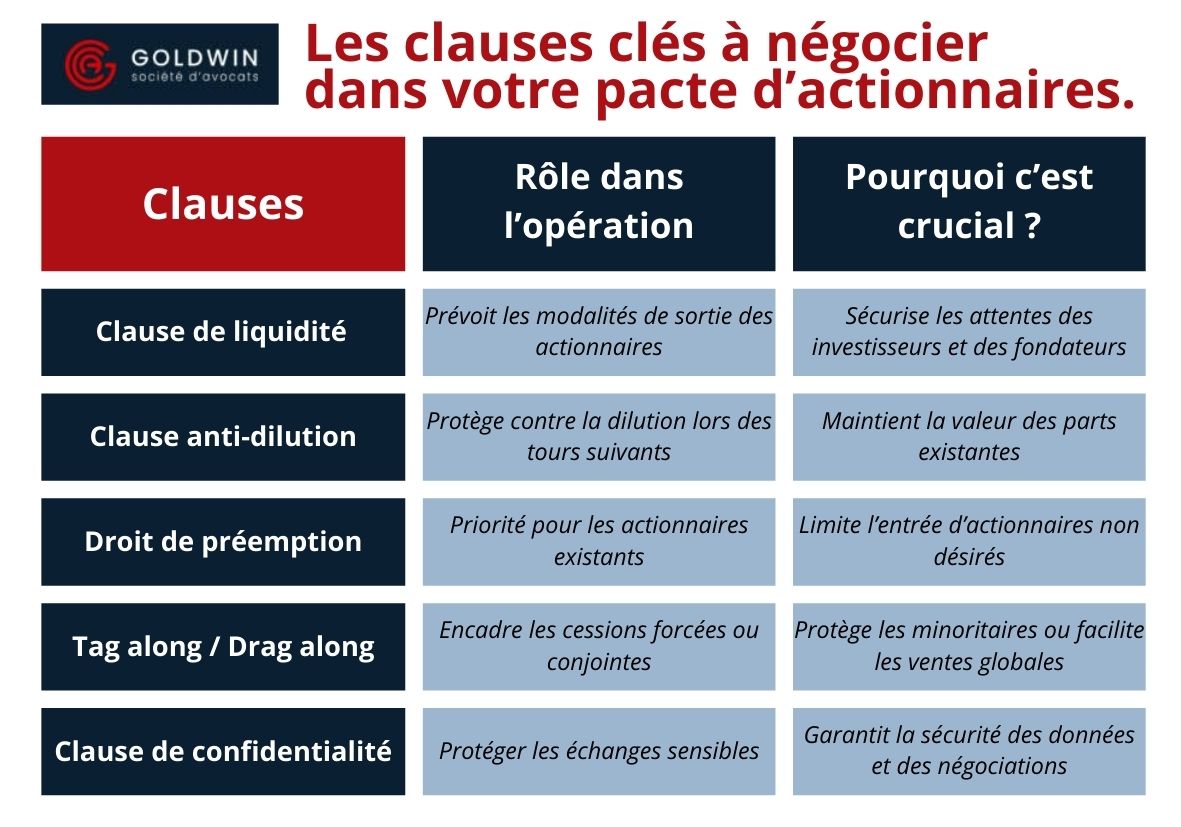

Clauses for shareholders’ agreements

What does a lawyer do after raising funds?

Monitoring shareholders’ agreements

Once the capital has been raised, it is essential to monitor the contractual agreements between the members of the company in order to guarantee its stability. The lawyer ensures that the commitments made at the time of the transaction are properly applied. He or she ensures that the rights and obligations of each shareholder are respected, particularly in terms of governance, exit from the company’s capital and the distribution of profits.

But the lawyer’s role goes beyond this: he also ensures that the entry of new investors does not undermine the protection of the company’s intangible assets. They ensure that intellectual property rights are protected, whether in the form of trademarks, patents, software or protected designs.

Specific clauses are included in the shareholders’ agreement to prevent any conflict relating to the ownership of these strategic rights, particularly in the event of a resale or change of control.

In the event of a change in capital or the arrival of new investors, the existing clauses are updated to maintain a secure legal framework. This support prevents disputes and strengthens trust between the company’s stakeholders.

Preparing for any secondary fund-raising

By anticipating your growth, the lawyer analyses your current shareholder structure and adjusts the articles of association to prepare for asecondary fund-raising. He will advise you on how to attract new investors without upsetting the existing shareholder base.

Anticipating the sale or transfer of your business

Your lawyer will optimise the tax treatment of the sale and guarantee the security of the process. They can help you manage a complex process that requires a thorough understanding of ownership and valuation issues.

As soon as the funds are raised, he will also anticipate the investors’ exit strategy to avoid future tensions. They incorporate appropriate exit clauses into the legal documentation, such as forced sale, tag along/drag along or liquidity clauses.

His role is decisive in negotiating favourable exit conditions for the founders and protecting the company’s long-term value. He will draw up the necessary documents and work with you to conclude the sale or transfer of the company.

Mistakes to avoid when choosing your fund-raising lawyer

Neglecting to specialise in fundraising

A lawyer who specialises in fund-raising has a thorough understanding of the specifics of the process, in particular the preparation of the decisive meetings that mark the operation. Thanks to this targeted expertise, you benefit from effective support that ensures the security of strategic decisions and facilitates communication with stakeholders. This helps you avoid mistakes that could slow down the process or weaken your negotiations.

Underestimating the importance of a relationship of trust

Trust between lawyer and client is a cornerstone of successful fundraising. Over and above technical expertise, it is the quality of the dialogue that guarantees a good understanding of your specific needs. Your lawyer must undertake to respect the strictest confidentiality, particularly in the case of sensitive communications with investors or members of the management team. A fluid relationship based on trust fosters informed decisions and puts you in a strong position at key stages.

Focusing solely on price

It’s a common mistake to make price your only selection criterion. It’s better to focus on personalised support, designed to meet your company’s specific needs. Choosing a lawyer based in Paris, if your company is based there, makes face-to-face discussions easier and speeds up the decision-making process during the strategic phases of your fund-raising. An experienced lawyer will help you anticipate legal constraints and structure your deal efficiently. This strategic choice optimises the success of the deal and strengthens your position with investors.

Choosing the right fundraising lawyer for a successful project

Choosing a fund-raising lawyer is a strategic step in securing your project and putting all the chances on your side for a successful outcome, whether you are an ambitious start-up or an entrepreneur looking for finance.

With the support of an experienced business lawyer, you can benefit from genuine assistance in raising funds, with legal solutions tailored to each project.

Goldwin Avocats is a recognised expert in fund-raising support, with a dedicated team to help you every step of the way to turn this complex task into a competitive advantage.

FAQ on fundraising lawyers

What is the role of a lawyer in negotiating a partnership agreement?

A lawyer is involved in securing each clause of the shareholders’ agreement, particularly with regard to the conditions under which shareholders may join or leave the company. He will take care to protect the interests of the founders, anticipate potential conflicts and balance the rights of the parties. Goldwin Avocats will work with you to negotiate an agreement tailored to your project, guaranteeing a stable relationship between the partners and a sound legal structure for your fundraising.

When should I consult a lawyer about raising funds?

It is advisable to consult a lawyer as soon as you start thinking about raising funds. Early assistance helps you to anticipate the legal issues, prepare the documentation and secure the financing strategy. Goldwin Avocats is involved from the preparatory phase to advise you on the best options and speed up your discussions with investors. This anticipation makes it easier to put in place the optimum framework for your deal.

Can a lawyer help with the drafting of the term sheet?

Yes, the term sheet is an important document that sets out the broad outlines of the deal before the final contracts are drawn up. A lawyer can help you to draft clear terms, secure negotiations and anticipate future issues. Goldwin Avocats will ensure that your term sheet is consistent with the final documentation, to avoid any unpleasant surprises. This support will enable you to approach the rest of the discussions with your investors with peace of mind.

What are the legal risks involved in raising funds?

Raising capital involves a number of legal risks: excessive dilution, disputes between partners, disclosure of sensitive information or unbalanced clauses. The absence of protection in the documentation can weaken your company. Goldwin Avocats can help you identify and limit these risks through personalised support. Their expertise secures the entire process, from preparing the documents to finalising the closing, to protect your company for the long term.

What is the difference between a seed round and a Series A?

A seed round finances the start-up of the business and the validation of the business model, often with smaller amounts. Series A funding is used to accelerate growth, structure the team and develop large-scale marketing. Goldwin Avocats can advise you on the specifics of each stage and help you structure your deals to maximise the value of your project, whatever the financing phase.

Should share warrants be used when raising capital?

Warrants are an interesting way of involving investors or key team members in the capital, without immediate dilution. They offer flexibility in the management of the fund-raising, by allowing a gradual increase in capital under certain conditions. Your lawyer will advise you on the advisability of using warrants and will ensure that they are properly incorporated into the legal documentation to secure the fundraising.

How can I ensure that contracts are properly drafted when raising capital?

The lawyer ensures that each contract complies with the legal framework and protects the interests of the founders. They check the conditions precedent, the liability guarantees and the obligations of the shareholders. Rigorous drafting reduces the risk of litigation and strengthens the solidity of the fund-raising operation.

How can intellectual property be protected when raising funds?

Protecting your intangible assets is essential. A lawyer will ensure that specific clauses are included in the shareholders’ agreement to govern the use of patents, trademarks or software. He or she will also monitor the ownership of rights and the confidentiality of exchanges. This protection enhances the value of your company in the eyes of investors.

Why is post-closing monitoring crucial to the success of your project?

Post-closing monitoring enables us to check that the commitments made at the time of fundraising are being honoured. The lawyer checks that the clauses of the shareholders’ agreement are being applied and supervises any capital increases or amendments to the articles of association. This in-depth work guarantees the company’s long-term legal and financial stability.

What alternatives to bank credit are there for financing your business?

In addition to bank credit, a company may consider fundraising, convertible bonds, warrants or even participative financing. Your lawyer will advise you on the solution best suited to your project and ensure that the transactions are legally compliant. This enables you to diversify your sources of capital while protecting your company.

How can I ensure the confidentiality of exchanges with investors?

The lawyer drafts appropriate confidentiality agreements (NDAs) and provides a framework for discussions to avoid any leakage of sensitive information. Particular attention is paid to the legal documentation and the clauses of the shareholders’ agreement to ensure that discretion is maintained throughout the transaction.