The Société Anonyme remains one of the most emblematic legal forms in French law. Whether the company is a long-established industrial concern or a recent project seeking to raise funds, it offers structured access to capital, supervised by a Board of Directors or an Executive Board.

This model attracts both individual and corporate shareholders, thanks to its management rules,public offering mechanisms and precise conditions forcontributions in cash or in kind.

The SA remains a central tool for initiatives requiring large-scale share subscriptions, capital increases or the issue ofsavings instruments.

But this type of company is not so simple: the Articles of Association have to be drawn up properly, the capital has to be deposited, the registered office has to be established, the accounts have to be organised and the rules laid down in the Commercial Code have to be anticipated. Any error may mean that the clauses of the Articles of Association have to be amended, or even that the internal code of governance has to be changed, which adds to the cost of setting up the company.

Goldwin Avocats has a proven track record in company law, supporting its clients from the first financial year through to the publication of annual financial reports. Whether it’s preparing an employment contract for an executive, advising a board member on his or her rights, or ensuring compliance on French territory, every director benefits from legal support that secures strategic decisions and ensures the company’s long-term future.

Key points to remember :

- Definition and nature of a public limited company: a joint stock company in which the shareholders hold shares; liability limited to the amount of contributions (except in the case of fraud or serious misconduct); registration = legal personality.

- Capital and shareholders: minimum share capital of €37,000 (50% paid up on formation); minimum of 2 shareholders (7 if listed on the stock exchange); ordinary shares or shares with special rights; possible clauses to control the entry of new shareholders.

- Organisation and governance: a choice of two models – Board of Directors + CEO (centralisation, speed) or Executive Board + Supervisory Board (separation of powers, greater control); terms of office of 3 to 6 years; obligations of loyalty and information on the part of directors.

- Tax and social security regimes: taxable by default atcorporate income tax rate (25%) with a temporary option to opt for personal income tax; dividends subject to flat tax (30%) or progressive scale (40% allowance); executives affiliated to the general social security system.

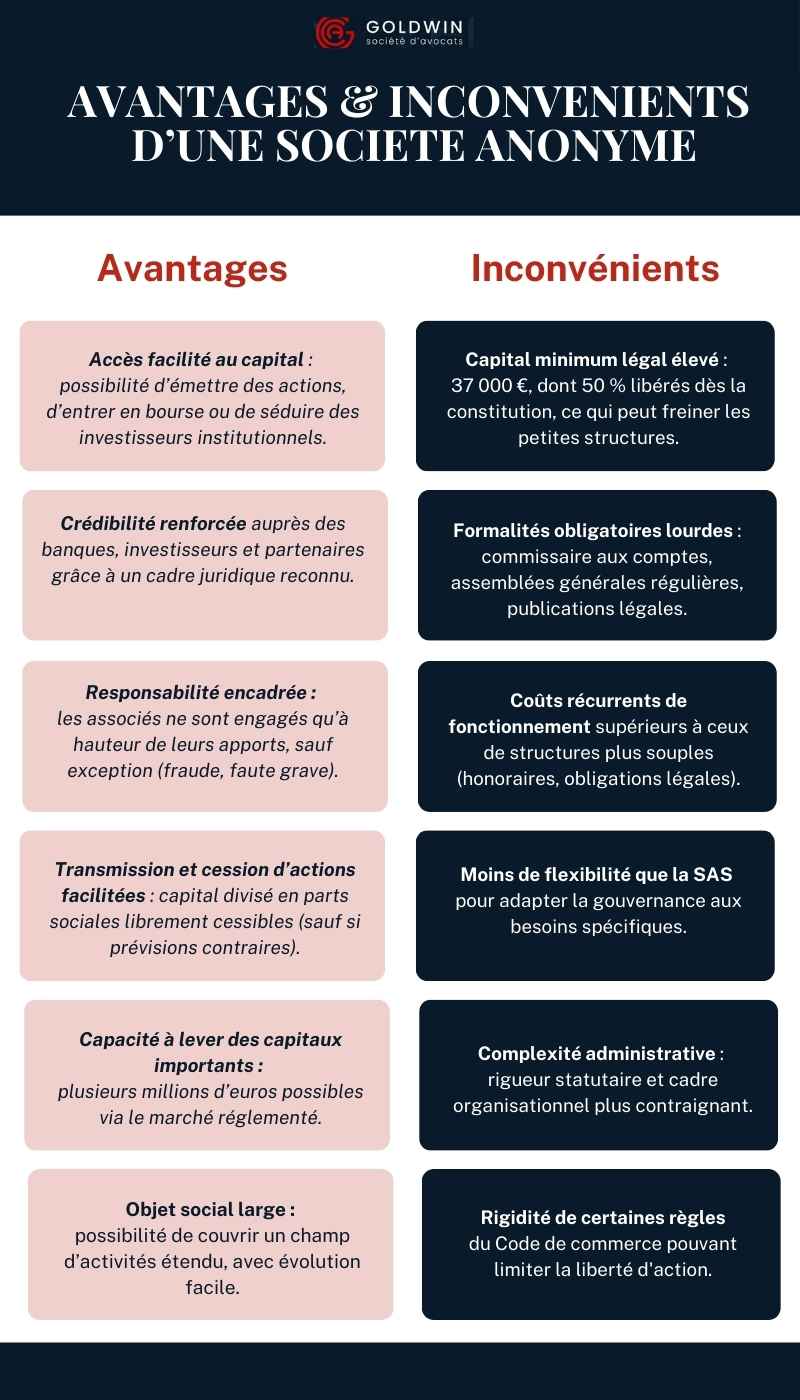

- Strengths, constraints and common mistakes: easy access to capital, credibility and ability to raise substantial funds; but strict formalism, high operating costs and rigid governance; classic mistakes to avoid: underestimating capital, neglecting articles of association, choosing the wrong governance, ignoring obligations.

Understanding the Société Anonyme

Legal definition and nature of a public limited company

The SA is defined by art. L225-1 to L225-270 of the French Commercial Code as a joint stock company in which shareholders hold shares. Limited liability protects the personal assets of each shareholder, who is liable for the company’s debts only to the extent of his or her contribution to the capital. This rule, which is set out in the first paragraph of the provisions on liability, is subject to only rare exceptions, notably in the case of gross mismanagement or fraud.

As soon as it is registered, the Société Anonyme acquires legal personality and its registered office is established. It then becomes an autonomous entity, represented by its management bodies. The choice between a Board of Directors or a Management Board determines the distribution of powers. The members of these bodies are appointed in accordance with the Articles of Association and the applicable legal provisions.

This form of governance guarantees a solid link between capital and management, while allowing shareholders to opt for the configuration best suited to the sector and country in which they operate.

Legal characteristics and specific features

Share capital and contributions

A Société Anonyme requires a minimum share capital of €37,000. This may seem high, but it sends a strong signal to partners and investors that the company has the resources to support its development.

This equity can be made up of two types of contribution:

- In cash: sums paid into a blocked account opened in the name of the SA being formed. At least 50% must be paid up on incorporation; the balance may be paid up within a maximum of 5 years.

- In kind: tangible assets (e.g. building, vehicle) or intangible assets (e.g. trademark, patent). In this case, an independent auditor assesses the value of the assets to ensure fairness between partners.

Precision is essential: a business lawyer checks compliance and anticipates disputes, particularly in the event of disagreement over the valuation of an asset.

Number of owners of shares and types of securities

An unlisted public limited company must have at least 2 shareholders; if it is listed on the stock exchange, this threshold rises to 7.

These shareholders may be individuals or legal entities, regardless of nationality.

The shares issued by a public limited company may be :

- Ordinary shares: these carry the right to vote at general meetings and the right to share in profits in proportion to shareholding.

- Shares with special rights: these may grant double voting rights, priority on dividends or specific prerogatives in the management of the company.

Although these shares are usually transferable without restriction, the articles of association may impose a condition of approval or pre-emption in order to control the entry of new shareholders.

Shareholder liability

The principle is clear:owners’ capital commitment is limited to their contributions. This protective framework attracts many investors, but it is not absolute. Fraud, serious misconduct or management that is manifestly contrary to the company’s interests may result in the personal liability of a director, chief executive or member of the management board.

Legal personality and legal regime

Registration in the Commercial Register marks the legal birth of the company. From then on, the SA acts as an autonomous entity, represented by its management bodies. It is subject to the rules of the Commercial Code, supplemented by the provisions of the Civil Code and the Labour Code where required by the business.

This separate legal status means that a public limited company can enter into commercial contracts, own separate assets and liabilities, initiate legal proceedings and be involved in litigation, without its shareholders being directly affected.

Organisation and operation

Public limited companies can take two forms

There are two main types of public limited company. The choice has a direct impact on the operating system and the decision-making process.

- Board of Directors and Chief Executive Officer (CEO)

In this configuration, a single body centralises management: the Board of Directors. The Chairman and Chief Executive Officer (CEO) combines the functions of Chairman of the Board and Chief Executive Officer. This type of organisation favours rapid decision-making and a clear line of authority. It is often adopted by medium-sized companies that want to maintain a strong link between the directors and the executive.

- Management Board and Supervisory Board

This second form separates management and control. The Management Board is responsible for day-to-day administration, while the Supervisory Board ensures that the choices made are in line with the company’s interests and the articles of association. This form of organisation is particularly suitable for listed companies or groups with a large number of investors, as it avoids the risk of excessive concentration of power.

In both cases, the distribution of powers must be precisely set out in the articles of association to avoid any ambiguity.

Role and status of company directors

The directors of a public limited company are not limited to the CEO or the members of the Management Board. Depending on the structure of the company, there may also be deputy managing directors, who are responsible for specific tasks, or independent directors.

Directors are generally appointed at a meeting of the Board of Directors or the Supervisory Board, depending on the structure chosen. Terms of office are often set at between 3 and 6 years, and may be renewed, subject to the conditions laid down by law and the company’s articles of association.

Directors must comply with rules of loyalty and disclosure to financial partners. In the event of serious misconduct, they may be held personally accountable for their actions.

A lawyer can play a preventive role in this respect, by ensuring the security of agency agreements.

General meetings and decision-making

In a public limited company, general meetings are the heart of corporate life. There are two main types of meeting:

- TheOrdinary General Meeting (OGM): convened at least once a year to approve the balance sheet, allocate profits and, where appropriate, set the remuneration of directors.

- TheExtraordinary General Meeting (EGM): necessary for any amendment to the Articles of Association, an increase or reduction in capital, or a major operation affecting the development of the company.

Voting rights vary according to the number of shares held.

A lawyer will ensure that the formalities are complied with (notices of meeting, deadlines, content of the agenda) to avoid any subsequent disputes. AGM or EGM, every vote counts. Goldwin Avocats transforms your general meetings into secure, enforceable decisions.

Control and transparency

Financial transparency is a key requirement for public limited companies. The appointment of an auditor is compulsory, even for unlisted companies. The auditor’s role is to certify the accounts, verify the accuracy of the financial information and alert the company to any irregularities.

Regular publication of reports enables shareholders and investors to monitor the company’s financial health. For companies listed on the stock exchange, regulations require an even higher level of communication, including quarterly publications and immediate information on any event that could influence the share price.

In the event of a tax audit or dispute with a partner, the lawyer prepares the documents and defends the company’s interests before the relevant authorities.

Ensure impeccable organisation: Goldwin Avocats’ lawyers assist public limited companies in holding their meetings and administering mandate contracts.

Tax and social security

Taxation of profits

By default, a public limited company is subject to corporation tax at the standard rate of 25%. Certain limited companies, when they meet specific conditions, such as sales below a certain threshold and equity paid in full, may benefit from a reduced rate of 15% on their first €42,500 of taxable profit.

There is also a temporary option forincome tax (IR), for 5 consecutive financial years. This option mainly concerns companies that have been in existence for less than five years, and the majority of whose shares are held by individuals. It may be appropriate in some cases, but should be examined with a tax lawyer to assess the real impact on taxation and net profit.

Social security regime for directors

Chairmen and Chief Executive Officers, sole Chief Executive Officers and members of the Management Board are covered by the general social security system . In practical terms, they enjoy the same benefits as employees: health insurance, pensions and provident schemes. The only major difference is that, unless they have a specific contract, they do not contribute to unemployment insurance.

This scheme is more expensive than self-employed status, but it has the advantage of attracting high-level executives because of the security it offers.

Taxation of shareholders

Shareholders are taxed on the dividends they receive. By default, this income is subject to a single flat-rate withholding tax (PFU ) of 30%, which includes 12.8% tax and 17.2% social security contributions. This system, sometimes referred to as “flat tax“, simplifies taxation but is not always the most advantageous depending on your personal situation.

It is possible to opt for taxation on the progressive income tax scale, which in some cases can reduce the tax bill, thanks in particular to the 40% allowance on dividends provided for in the General Tax Code. Here again, the support of a professional is essential to compare the scenarios and choose the best option.

Advantages and disadvantages of the SA

The public limited company offers solid advantages for large-scale initiatives, but also has stricter legal and organisational requirements than other legal forms.

Procedure for setting up a public limited company

Key stages

Setting up a public limited company involves following a strict process:

- Drawing up the Articles of Association: this document sets out the legal form, thecorporate object, the amount of share capital and the management and voting procedures.

- Capital deposit: minimum €37,000, 50% of which must be paid up immediately in cash, with the remainder to be paid up within 5 years.

- Legal publication: insertion in a legal gazette specifying the name, registered office, par value of securities and number of shares subscribed and paid up.

- Registration with the RCS (Registre du Commerce et des Sociétés): filing of the application with the RCS (Registre du Commerce et des Sociétés), with attribution of the SIREN number and publication in the BODACC(Bulletin officiel des annonces civiles et commerciales).

Documents and formalities

The formalities include :

- The articles of association signed by all the partners.

- Proof of capital deposit (bank certificate).

- A list of directors, members of the management board or supervisory board.

- Proof of address.

- The M0 form, completed and signed.

- The legal publicity notice.

Each document must comply with the legal provisions, otherwise the application will be rejected. One mistake is enough to block the creation of your SA. Don’t take that risk: Goldwin Avocats will secure your articles of association, your filings and all your formalities to ensure that your company is registered without a hitch.

Costs and deadlines

The total cost varies depending on the nature of the company:

- Administrative costs : around €500 to €1,000 (registration, legal notices).

- Fees, if any: the services of a lawyer or chartered accountant may represent an initial investment of €1,500 to €3,000, but will ensure that the business is properly set up and managed.

The average time between preparation of the documents and official registration is 2 to 4 weeks. Professional advice often avoids the need to go back and forth between the various administrative bodies, thereby reducing the time taken.

The role of the lawyer in setting up and structuring a public limited company

A lawyer specialising in company law will be involved from the outset of the project to ensure that every stage is secure.

In particular, he can help with :

- Draft clear and comprehensive Articles of Association that are tailored to the objectives and organisation required.

- Incorporate precise governanceprovisions (division of powers, decision-making procedures, quorum rules).

- Put in place protective mechanisms such as pre-emption clauses to control the sale of shares, temporary non-transferability clauses to stabilise share ownership, and a balanced organisation of powers between the Board of Directors, the Management Board and the Supervisory Board.

- Make shareholders’ agreementsmore secure and include provisions to avoid blockages (approval clauses, joint exit).

- Guide the distribution of share capital to avoid excessive concentration of votes or deadlock at general meetings.

- Anticipate the risk of conflicts between partners or directors by means of protective provisions.

- Check regulatory compliance at every stage, from registration to legal publicity.

- Support for strategic transactions: capital increases or reductions, transfer of securities, change of legal form.

In doing so, the lawyer :

- Ensures optimum legal security for the company and its directors.

- Saves the founders time by simplifying the formalities.

- Preserves operational flexibility while complying with legal obligations.

Don’t leave the future of your company to chance.

Contact Goldwin Avocats now to secure the creation and structuring of your SA on solid foundations.

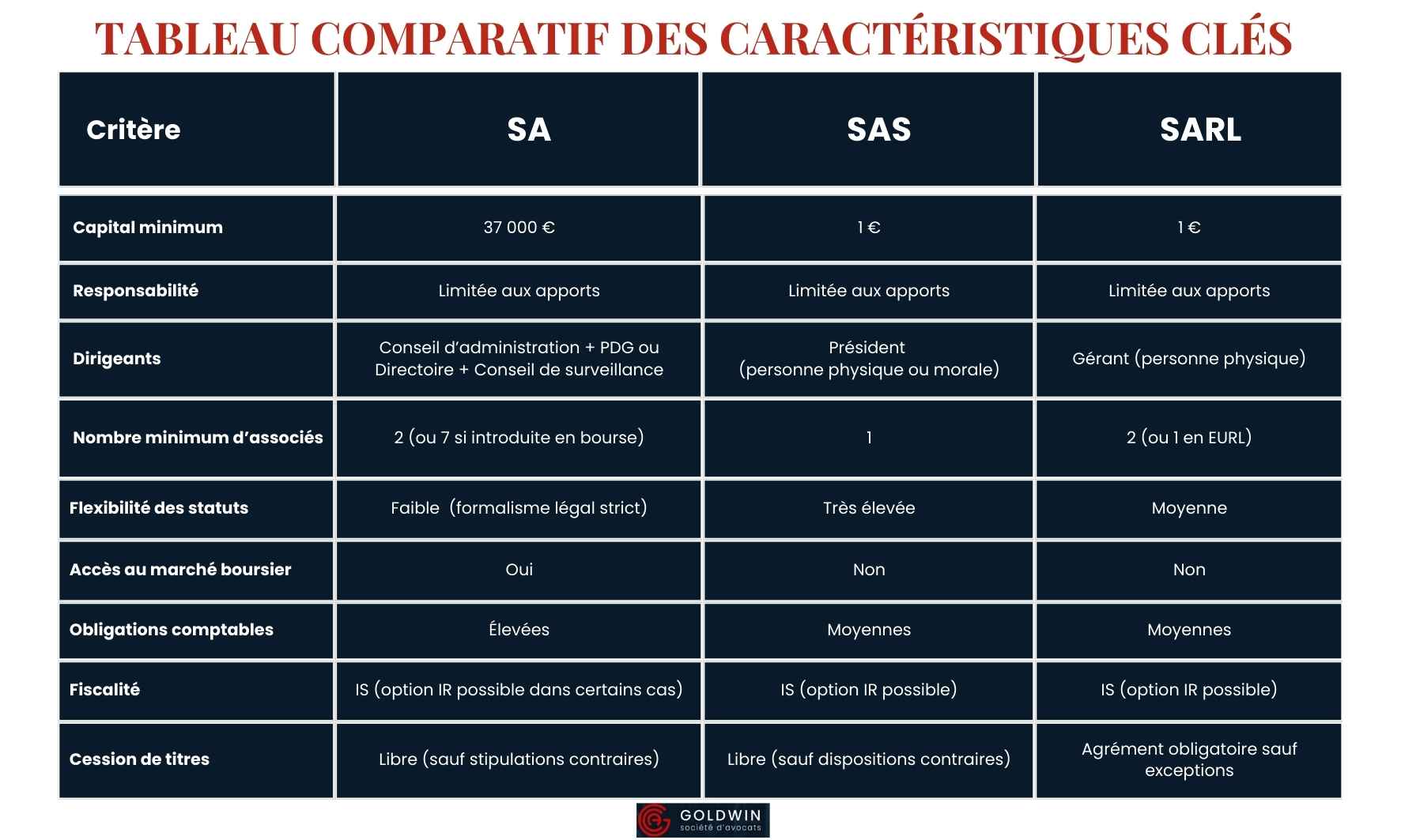

Comparisons with other types of company

SA vs SAS

The Société Anonyme (SA) and the Société par Actions Simplifiée (SAS) are both limited companies, but the SAS offers much greater flexibility in its articles of association. The Articles of Association define almost the entire internal organisation of the company, whereas the SA is subject to stricter formalities.

The SA is preferred for start-ups that require large amounts of capital and that are open to the public (stock exchange, banks), while the SAS is better suited to growing companies looking to adapt their structure quickly.

SA vs SARL

The SARL(Société à Responsabilité Limitée) is a more ” family ” type of company, suited to smaller structures. The rules are simpler for day-to-day administration.

On the other hand, unlike the SA, the SARL cannot raise funds on the stock markets or issue freely transferable shares.

Comparison of key features :

The choice of legal form is decisive. Goldwin Avocats analyses your objectives, compares the tax and legal implications and guides you towards the most appropriate solution.

10 common mistakes made by people setting up a public limited company

- Underestimating the minimum capital required.

- Neglecting to draft the articles of association.

- Choosing the wrong form of governance.

- Ignoring legal obligations.

- Minimise the liability of directors.

- Omit shareholder agreements.

- Poor tax planning.

- Failing to prepare for the transfer or entry of investors.

- Neglecting regulatory compliance.

- Wanting to manage everything alone.

Avoid these mistakes from the outset. Contact Goldwin Avocats to secure the creation and management of your SA with tailor-made support.

Your SA, well thought out from the outset

The public limited company (SA) remains one of the most suitable options for ambitious initiatives: minimum capital of €37,000, easier access to capital markets, controlled governance and enhanced credibility with investors. However, there are strict formalities involved in setting it up, from the drafting of the Articles of Association to accounting and legal obligations. Understanding its advantages, limitations and structure is essential if you are to avoid common mistakes and secure its development.

Goldwin Avocats can help you set up and optimise your SA, anticipating each key stage. Contact us to (re)structure your company on solid foundations.

Frequently asked questions about Public Limited Companies (PLCs)

What are the conditions for creating a public limited company with worker participation?

A ” société anonyme à participation ouvrière” allows employees to become shareholders and participate in decision-making. It is governed by the same incorporation rules as a conventional public limited company (SA), while incorporating specific provisions set out in the French Commercial Code. Thecompany’s objects must mention this principle, and internal regulations specify the distribution of shares and the sharing of profits.

What is the difference between a société anonyme and a société coopérative?

A société anonyme is a capital company that generally aims to make a profit for its shareholders, whereas a société coopérative focuses on the collective interests of its members. The rules governing voting, the distribution of profits and the entry of members are different. Cooperatives operate on the principle of “one person = one vote“, whereas in a public limited company, voting rights depend on the number of shares held.

Is it possible to set up a public limited company with a single shareholder?

A public limited company cannot be formed with a single shareholder. The law requires a minimum of 2 partners (and seven if the company is listed on the stock exchange). This requirement reflects the collective nature of the SA and its aim of mobilising substantial financial resources. The SAS or EURL are more suitable if you want to start a business on your own.

Is there a maximum number of shareholders in a public limited company?

The law does not set a maximum number of shareholders for a public limited company. This makes it possible to welcome a large number of investors and to raise substantial amounts of capital. However, if the SA is listed on the stock exchange, it must comply with specific market and transparency rules. The number of shareholders must always be consistent with the management and strategic steering resources.